In the intricate world of estate planning, the decision to establish a trust is not one to be taken lightly. Trusts have long been favored for their ability to provide a secure and efficient means of safeguarding assets for future generations. As experienced practitioners at Morgan Legal Group in New York City, we understand the importance of careful consideration when it comes to the establishment of a trust. Join us as we delve into the myriad of reasons why a person may choose to set up a trust, exploring the various benefits and advantages that this method of asset protection can offer. From ensuring privacy and control over assets to minimizing tax liabilities and avoiding probate, the possibilities are endless when it comes to the potential advantages of a trust. Join us as we navigate the complexities of trust formation and unravel the many reasons why this estate planning tool may be the solution for you.

Advantages of Establishing a Trust for Estate Planning

One of the key is the ability to avoid probate. Probate can be a lengthy and costly process that ties up assets and can cause family disputes. By placing your assets in a trust, you can ensure that they will pass directly to your named beneficiaries without the need for probate.

Another benefit of setting up a trust is the ability to maintain privacy. Unlike a will, which is a public document subject to probate court proceedings, a trust allows your assets and distribution plan to remain private. This can help protect your family’s privacy and ensure that your estate plan remains confidential. Additionally, trusts provide flexibility in managing and distributing assets, allowing you to specify conditions for distribution, such as age or achievement milestones, and protect assets from creditors. Overall, a trust can be a valuable tool in creating a comprehensive estate plan that meets your specific needs and goals.

Protection of Assets and Privacy Through Trusts

Setting up a trust can be a powerful tool for individuals looking to protect their assets and maintain privacy. Trusts allow individuals to transfer ownership of their assets to a separate legal entity, known as the trust, which is managed by a trustee. By doing so, individuals can safeguard their assets from creditors, lawsuits, and potential disputes among family members. This level of protection can be particularly beneficial for individuals with substantial assets or those who want to ensure their beneficiaries are taken care of in the future.

Moreover, trusts offer a high level of privacy as the details of the trust and its assets are not required to be made public. This confidentiality can be appealing to individuals who value their privacy and wish to keep their financial affairs out of the public eye. Additionally, trusts can help individuals avoid the probate process, which can be time-consuming and costly. By setting up a trust, individuals can ensure that their assets are distributed according to their wishes without the need for court intervention.

Tax Benefits and Asset Management with Trusts

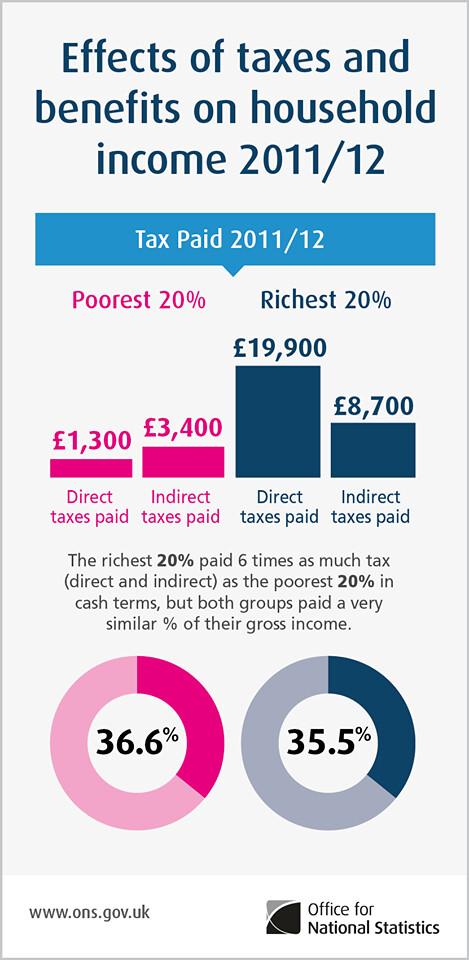

Setting up a trust can provide numerous benefits, particularly in terms of tax efficiency and asset management. One of the main reasons why individuals choose to establish a trust is to minimize their tax liability. By transferring assets into a trust, the trust becomes the legal owner of those assets, resulting in potential tax savings for the grantor. Trusts also offer privacy and confidentiality, as they do not go through the probate process, which can be time-consuming and costly.

Furthermore, trusts allow for the seamless transfer of assets to beneficiaries upon the grantor’s passing, without the need for court intervention. This can help streamline the asset distribution process and ensure that the grantor’s wishes are carried out as intended. Additionally, trusts can provide protection for assets from creditors and lawsuits, making them a valuable tool for asset preservation and wealth management.

Considerations for Setting Up a Trust in New York City

Setting up a trust in New York City can provide individuals with a variety of benefits and protections for their assets. One of the main reasons a person may want to establish a trust is to ensure their assets are protected and distributed according to their wishes. By creating a trust, individuals can have control over how and when their assets are distributed, ensuring that their loved ones are taken care of in the future.

Additionally, setting up a trust can also help individuals minimize estate taxes and avoid the probate process. Trusts can be a powerful tool in estate planning, allowing individuals to transfer assets to their beneficiaries outside of probate court. This can help save time and money, as well as maintain privacy for the beneficiaries. Overall, a trust can provide peace of mind and a solid foundation for an individual’s estate plan.

Q&A

Q: Why would someone choose to set up a trust?

A: Setting up a trust allows individuals to protect their assets and ensure they are distributed according to their wishes after their passing. Trusts also offer privacy, control, and flexibility in how assets are managed and passed on to beneficiaries.

Concluding Remarks

In conclusion, setting up a trust can be a powerful tool for protecting assets, ensuring the well-being of loved ones, and maintaining privacy and control over your estate. Whether you are looking to safeguard your wealth for future generations, minimize taxes, or simply streamline the process of passing on your assets, a trust can provide numerous benefits. By understanding the various reasons why a person may want to set up a trust, you can make informed decisions about your estate planning and secure a legacy for the future. So, if you are considering establishing a trust, be sure to consult with a qualified estate planning attorney to explore the options that best suit your needs.