In a world where fortunes can be made and lost in the blink of an eye, the concept of inheritance holds a unique and enduring fascination. But what exactly constitutes a “large” inheritance? Is it a specific dollar amount, a certain number of assets, or perhaps something more intangible? Join us as we delve into the complex and often subjective nature of wealth transfer and explore what society deems to be a truly substantial inheritance.

Understanding the Factors that Determine a Large Inheritance

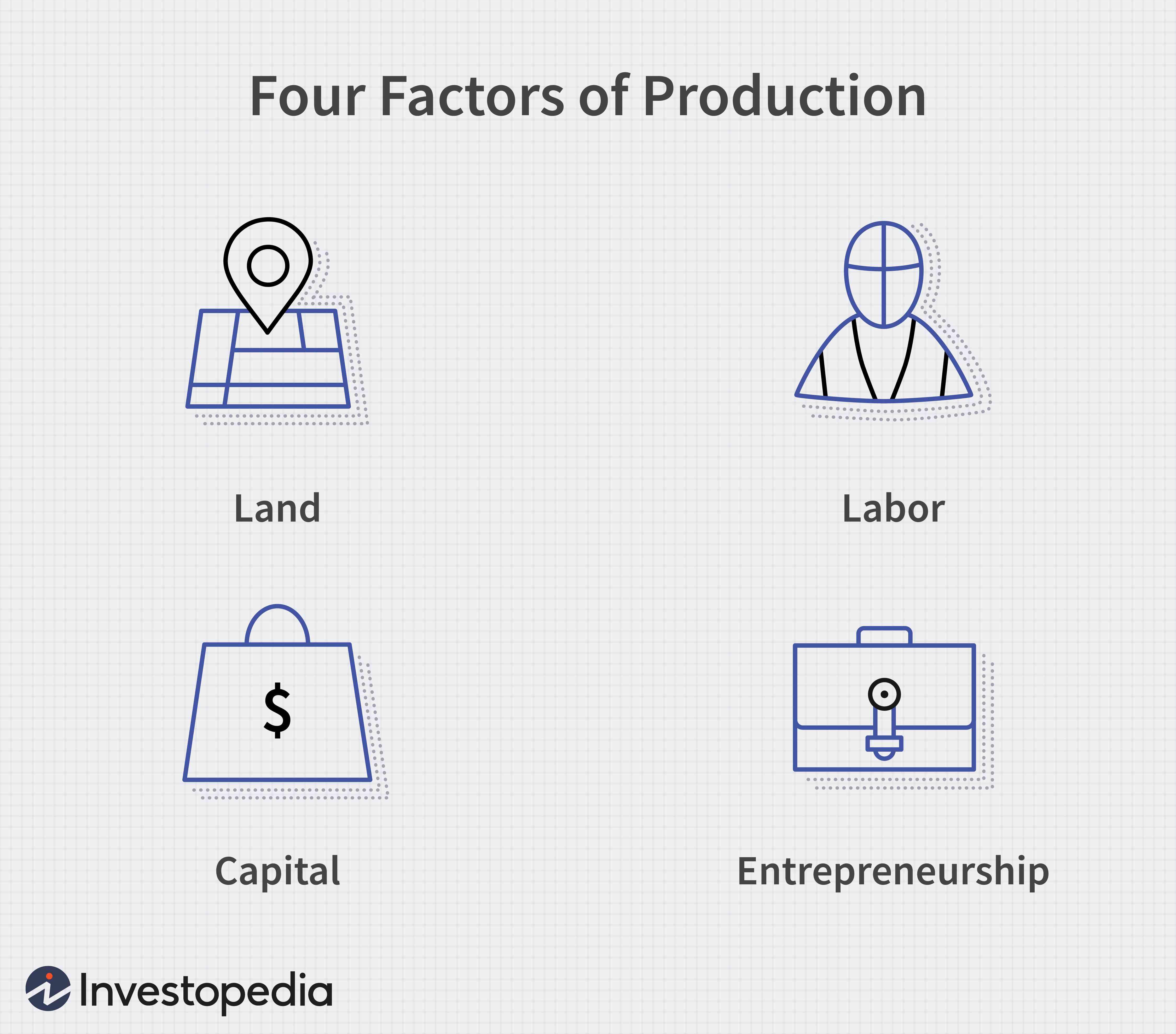

When it comes to determining what is considered a large inheritance, there are several factors that come into play. One of the key factors is the total value of the assets being inherited. This includes everything from real estate properties and investments to cash and personal belongings. The more valuable the assets, the larger the inheritance is likely to be.

Another factor to consider is the number of beneficiaries involved. If an inheritance is being split among multiple recipients, each individual’s share may be smaller compared to if the inheritance was only going to one person. Additionally, the relationship between the deceased and the beneficiary can also impact the size of the inheritance. Close family members such as children or spouses may receive a larger portion compared to distant relatives or friends.

Navigating Tax Implications of Receiving a Significant Inheritance

When it comes to determining what is considered a large inheritance, it can vary greatly depending on individual circumstances. In general, a significant inheritance is typically one that has a substantial impact on the recipient’s financial situation. This could include a large sum of money, valuable assets such as real estate or investments, or a combination of both. Ultimately, what is considered “large” will depend on factors such as the size of the estate, the number of beneficiaries, and the value of the assets being inherited.

Receiving a substantial inheritance can come with a number of tax implications that recipients should be aware of. Some key considerations include:

- Estate Tax: In some cases, the estate may be subject to estate tax, which could impact the value of the inheritance.

- Capital Gains Tax: If the inherited assets are sold for a profit, the recipient may be subject to capital gains tax on the appreciation.

- Income Tax: Any income generated from inherited assets, such as rental income or dividends, will be subject to income tax.

Strategies for Managing and Growing a Substantial Inheritance

When it comes to determining what is considered a large inheritance, the answer can vary greatly depending on individual circumstances. In general, a substantial inheritance is typically defined as receiving a significant amount of money or assets that can significantly impact one’s financial situation. This could include receiving a large sum of money, valuable property, stocks and bonds, or other valuable assets.

For some, a large inheritance may be tens of thousands of dollars, while for others it could be millions. It ultimately depends on the size of the estate and the financial situation of the individual receiving the inheritance. Regardless of the amount, managing and growing a substantial inheritance requires careful planning and strategic decision-making to ensure long-term financial stability and growth. Implementing a diversified investment strategy, seeking professional financial advice, creating a solid financial plan, and considering tax implications are all essential strategies for effectively managing and growing a significant inheritance.

Closing Remarks

In conclusion, the concept of a large inheritance is subjective and can vary greatly depending on individual circumstances and perspectives. While some may consider a million dollars to be a substantial amount, others may view it as just a drop in the bucket. Ultimately, the true value of an inheritance lies not in its size, but in the memories and values passed down through generations. As we navigate the complex world of inheritance and wealth, let us remember that true richness is found in the intangible gifts of love, wisdom, and legacy.