Imagine creating a life together with your partner, sharing memories, dreams, and assets. In the event of one partner’s passing, what happens to the joint bank account? Many assume that the account automatically goes to the survivor, but is this always the case? Let’s delve into the intricate world of joint bank accounts and what happens when one account holder passes away.

Understanding Joint Bank Accounts

So you’ve decided to open a joint bank account with your partner or family member. One common misconception is that if one account holder passes away, the remaining funds automatically go to the survivor. However, this is not always the case and it’s important to understand the implications of joint bank accounts.

**Here are some key points to consider:**

- Joint accounts typically have rights of survivorship, meaning that if one account holder dies, the remaining balance is automatically transferred to the surviving account holder.

- However, in some cases, the funds in a joint account may be subject to legal disputes if there are conflicting beneficiaries or claims on the money.

Legal Implications of Joint Bank Accounts

When it comes to joint bank accounts, many people believe that the funds will automatically go to the surviving account holder if one of the account holders passes away. However, this is not always the case. The can vary depending on the specific circumstances and the laws of the jurisdiction.

One important thing to consider is how the joint bank account is set up. In some cases, joint accounts may be set up as “joint tenants with rights of survivorship,” which means that if one account holder dies, the funds in the account will automatically pass to the surviving account holder. However, if the account is not set up in this way, the funds in the account may be subject to the deceased account holder’s estate and may need to go through the probate process before being distributed to the surviving account holder.

Handling Joint Bank Accounts After Death

When a loved one passes away, handling their finances can be a daunting task. One question that often arises is what happens to a joint bank account after the death of one account holder. Many people assume that the surviving account holder automatically inherits the funds in the joint account, but this is not always the case.

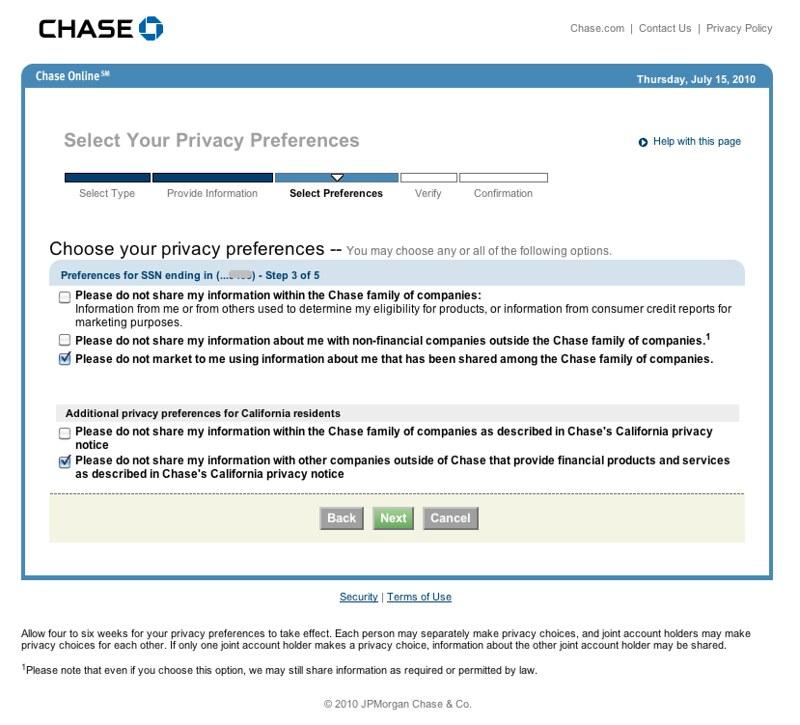

In some cases, the funds in a joint bank account may indeed go to the surviving account holder. However, there are several factors that can impact this outcome, such as the laws in your state, the specific terms of the joint account agreement, and any estate planning documents that may be in place. It’s important to carefully review all of these factors to determine how the funds in a joint bank account will be distributed after the death of one account holder.

Tips for Managing Joint Bank Accounts

Are you wondering what happens to a joint bank account when one account holder passes away? Contrary to popular belief, a joint bank account does not automatically go to the survivor. Here are some important :

- Communication is key: Make sure to have open and honest conversations with your joint account holder about your financial goals and responsibilities.

- Keep track of transactions: Regularly monitor account activity to ensure there are no unauthorized withdrawals or suspicious transactions.

- Review beneficiary designations: Update beneficiary designations on the account to make sure that funds go to the intended recipients in case of death.

In Summary

In conclusion, the question of whether a joint bank account automatically goes to the survivor is dependent on various factors, including the laws in your jurisdiction and the terms of the account agreement. It is always recommended to consult with a legal professional or financial advisor to fully understand your rights and obligations in the event of the account holder’s passing. Ultimately, being proactive and informed can help ensure a smooth transition of assets and financial security for your loved ones. Thank you for reading!